Blog - Categories

Category: Financing (16 posts)

Understanding Capital Gains in Canada

November 11, 2024 | Posted by: Harold Hagen

What Are Capital Gains? Capital gains refer to the profit you earn when you sell a capital asset-such as property or investments-for more than its original purchase price. For example, if you bough ... [read more]

7 Financial Tips for People Looking to Buy an Investment Property in Canada

July 19, 2024 | Posted by: Harold Hagen

Investing in real estate can be a powerful way to build wealth, but it's essential to approach it with a well-thought-out strategy. Here are seven financial tips to help you purchase an investment pro ... [read more]

Know the warning signs of heat exhaustion and heatstroke

July 17, 2024 | Posted by: Harold Hagen

The hot summer heat is here, and with it comes the risk for heat-related illnesses. Heat-related illnesses can range from mild conditions like heat cramps and rashes to moderate illnesses like heat ex ... [read more]

Tips for Improving Your Credit Score Before Applying for a Mortgage

November 1, 2023 | Posted by: Harold Hagen

Tips for Improving Your Credit Score Before Applying for a Mortgage For many people, buying a home is a significant milestone in their lives. However, getting approved for a mortgage is ... [read more]

Rental Cash Damming 101, Part 1

August 10, 2023 | Posted by: Harold Hagen

What Is Rental Cash Damming? Cash damming is a CRA-approved financial strategy aimed at transforming non-tax-deductible personal debt into tax-advantaged business or investment debt. This str ... [read more]

Bank Of Canada Rate Update June 7, 2023

June 7, 2023 | Posted by: Harold Hagen

Bank of Canada raises policy rate 25 basis points, continues quantitative tightening The Bank of Canada today increased its target for the overnight rate to 4.75%, with the Bank Rate at 5% and the ... [read more]

First Home Savings Account (FHSA)

April 11, 2023 | Posted by: Harold Hagen

First Home Savings Account (FHSA) In its 2022 Federal Budget, the Canadian Government introduced the First Home Savings Account (FHSA) a new registered savings plan designed to help Canadians ... [read more]

A Six-Step, Back to Basics Financial Plan for Most Every Canadian

November 21, 2022 | Posted by: Harold Hagen

It's a tough time to know what the right financial move is at the moment. Interest rates are increasing, while stocks are in bearish territory. It's easy to forget that there are smart things that you ... [read more]

Gut Punch from the Bank of Canada

October 12, 2022 | Posted by: Harold Hagen

Last Thursday, Bank of Canada Governor Tiff Macklem gave a speech, quite simply titled, “Restoring price stability to Canadians”. I won’t bore you with the entire speech, but ... [read more]

Covid-19 Managing Uncharted Waters

March 23, 2020 | Posted by: Harold Hagen

Covid-19 Managing Uncharted Waters As the current health crisis plays out, the months ahead may potentially prove to be trying times. For people with debt, and in particular mortgage debt, mone ... [read more]

First -Time Home Buyer Incentive

February 29, 2020 | Posted by: Harold Hagen

The Federal Government’s new First-Time Home Buyer Incentive (FTHBI) program offers an interest free loan towards the purchase of a new home for up to 25 years. Launched September 02, 20 ... [read more]

Dutch Disease - Economy

February 22, 2020 | Posted by: Harold Hagen

As part of my daily effort to monitor the pulse of the Canadian economy and understand market future trends, I pay close attention to historical economic patterns. For example, five years ago Can ... [read more]

The Dream - Susan's story

February 18, 2020 | Posted by: Harold Hagen

Susan had moved to Red Deer, Alberta three years ago with her two teenage children. Owning a home had been a long-time dream of hers, but since she had always been a renter, and her growing children w ... [read more]

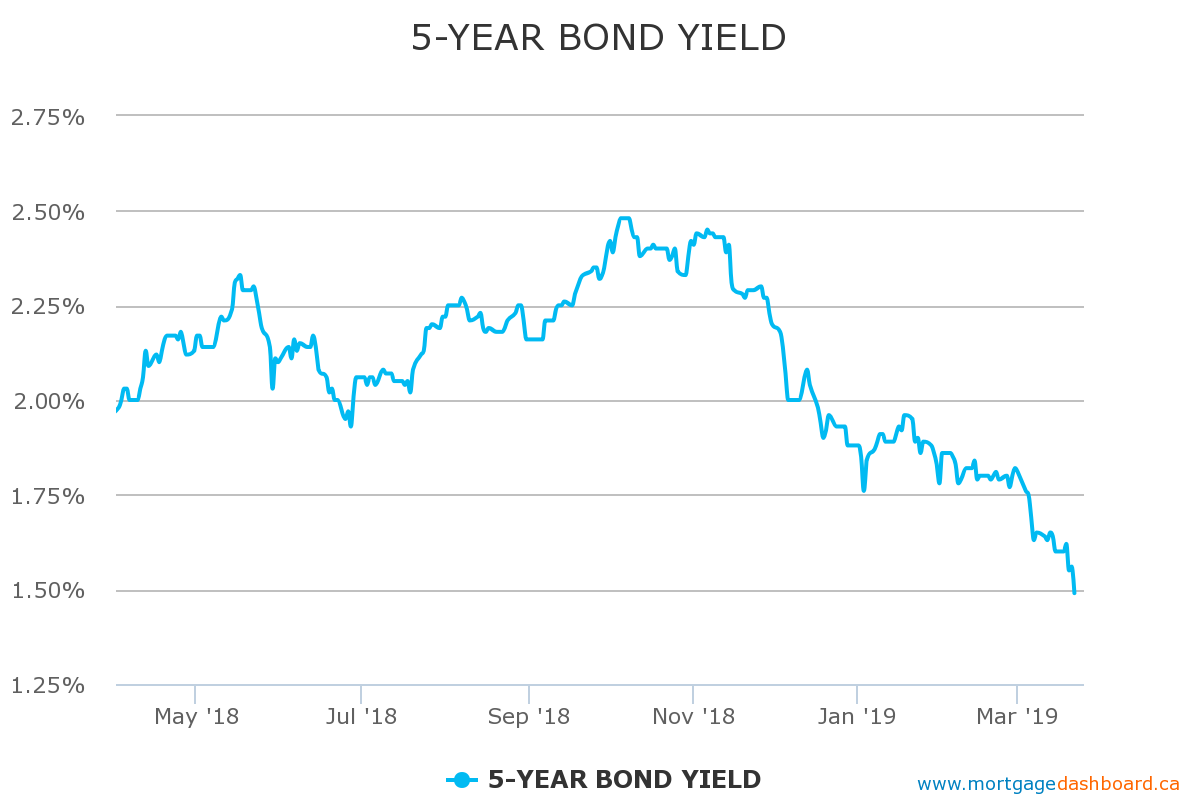

Bank of Canada; Saving Green

March 22, 2019 | Posted by: Harold Hagen

Up till now, BoC Governor Stephen Poloz had stated repeatedly that the overnight rate (currently at 1.75%) would need to reach the Bank’s “neutral range” target of 2.5-3.5%. “ ... [read more]

Strategies to Dig Yourself Out of the Debt Hole

March 14, 2018 | Posted by: Harold Hagen

Debt. It's something almost everyone will have at some point in their life. But what happens when your debt begins to get the better of you? What options are available? Some simple strategies can he ... [read more]

Why You Need an Emergency Fund And How to Get One

March 7, 2018 | Posted by: Harold Hagen

Building an emergency fund is something most people know they should do but few actually get around to doing. A recent study found that nearly two-thirds of Americans did not have an emergency fund, a ... [read more]