Dutch Disease - Economy

February 22, 2020 | Posted by: Harold Hagen

As part of my daily effort to monitor the pulse of the Canadian economy and understand market future trends, I pay close attention to historical economic patterns. For example, five years ago Canadian economists were waging an argument over whether or not Canada was suffering from a form of “Dutch Disease”. The term, which emanated in the late 1970’s by the “The Economist”, described the unexpectedly poor performance of the Dutch economy following a major natural gas discovery in 1959. But that was back in 2014, and oil prices then were much higher than they are today.

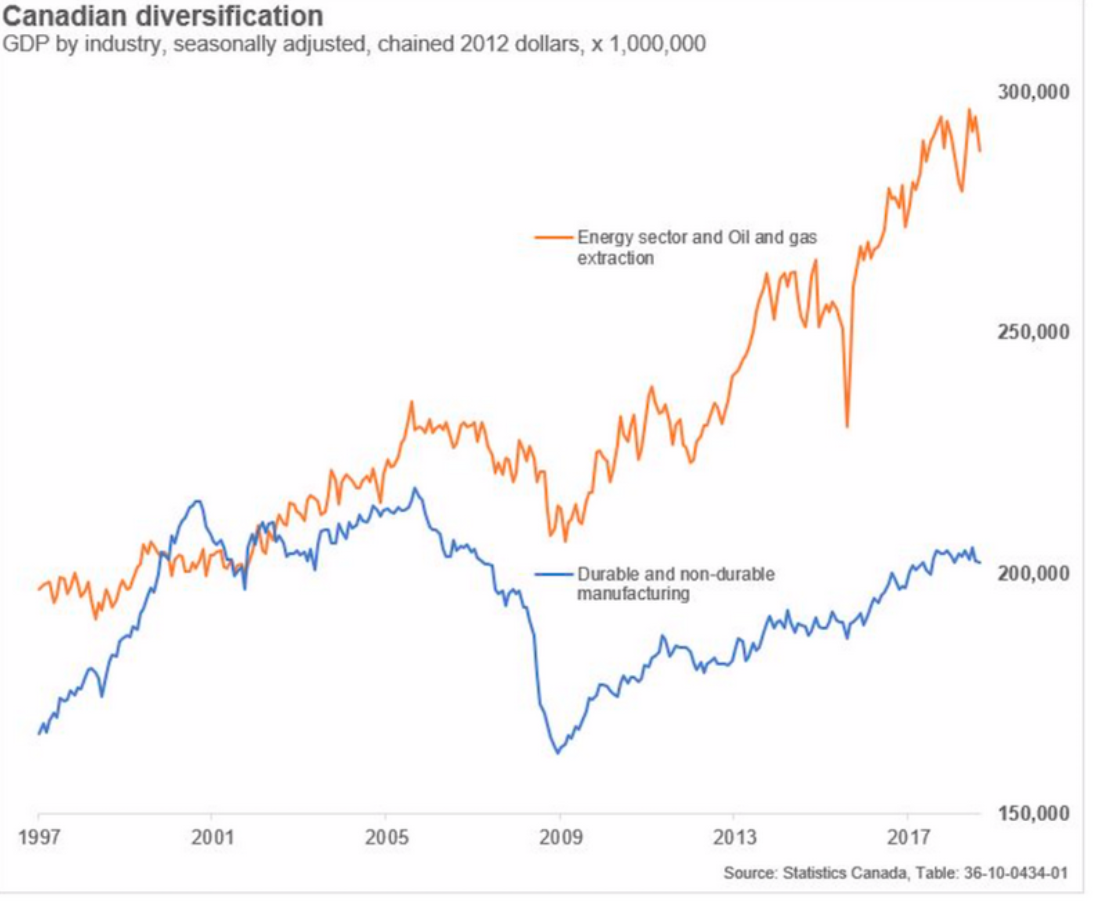

Today, we can see just how much Canada’s economy has been dependent upon its non-renewable energy sector. As is evident in this chart by @hmacbe, the underlying message is that this financial compression is not borne by only a few under diversified energy resource-centric provinces, but rather by the entire nation. Not only does inter-provincial dependency on transfer payments strain national political relations, it has a deep and significant impact on Canada’s GDP and ability to compete in the international market.

Hilliard Macbeth, author and portfolio manager, @hmacbe

Although the total NAICS production classification picture is not represented here, it does shine a glaring light on the enormous contribution the energy sector bears on Canada’s welfare when compared to the manufacturing sector. When cross-referenced to Statistics Canada published GDP numbers, I couldn’t validate the magnitude difference depicted in this chart, but the Canadian energy sector seasonally adjusted rate still represents a significant national concern.

It’s not only Alberta needs to diversify, Canada needs to also diversify its interests to remain a leader on the national trading stage.